CoPeace Announces Strategic Investment in Uncharted Power

NEW YORK – CoPeace (Companies of Peace) – an innovative impact holding company, announced a strategic investment in Uncharted Power – a power and data technology company addressing the infrastructural issues for the generation, transmission, and storage of power to underserved communities. This investment marks the first holding for the CoPeace finance portfolio.

Uncharted Power was specifically selected by CoPeace for its proprietary technology and active solutions towards critical social and environmental issues facing the world. In addition, CoPeace analyzed the long-term profitability and impact potential of Uncharted Power. Given CoPeace’s management expertise, the two will partner on the exploration of project finance opportunities for domestic infrastructure projects.

“After evaluating over 100 companies, we determined Uncharted Power presented an incredible opportunity as our first strategic partner in our new portfolio. Jessica O. Matthews and the team at Uncharted Power have a brilliant system of solutions for our country’s growing infrastructural needs. We are impressed with their technology’s innovative and unique approach to providing power and data to under-served communities in a way that is proactively combating the climate crisis,” said Craig Jonas, CoPeace founder and CEO.

In 2016, Jessica O. Matthews, Uncharted Power’s founder and CEO, raised what was at the time, the largest-ever Series A by a black female founder. Under the Ford Freedom Award winner and Forbes 30 Under 30 recipient’s leadership, the company continues to accumulate a myriad of accolades and recognition. It was most recently featured on TBS Network’s prime-time show, Full Frontal with Samantha Bee, discussing the existing biases in tech and innovating for the global economy.

“It is important as we continue to accomplish our mission of decentralizing and democratizing power, that we partner with firms with a similar ethos and approach to the future of infrastructure,” said Matthews. “We could not be more pleased to welcome CoPeace to the Uncharted Power community.”

Based in Harlem, New York, Uncharted Power provides infrastructure solutions for cost-efficient energy, along with data transmission and storage, utilizing its cutting-edge hardware and software technology. Additionally, Uncharted Power addresses the exigent climate crisis with its renewable energy focus.

CoPeace is an innovative impact holding company, driving mission-grounded change through its growing portfolio of complementary subsidiaries, while creating a more inclusive investing space. CoPeace is structured as a public benefit corporation and received pending B Corp status.

CoPeace has raised capital from its private network of investors and plans to launch a direct public offering under Regulation A later this year, providing an investment opportunity to the general public.

For more information about CoPeace, visit copeace.com. For more information about Uncharted Power, visit www.u-pwr.co.

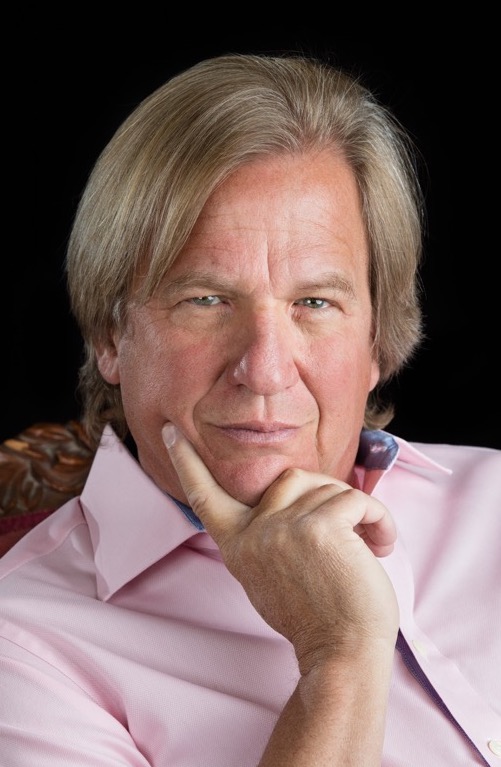

Jed Emerson to Serve as Senior Strategic Advisor

DENVER – Jed Emerson will serve as a senior strategic advisor to CoPeace, founder and CEO Craig Jonas announced Wednesday. Emerson, a thought leader in the field of impact investing, will advise CoPeace and provide strategic guidance.

DENVER – Jed Emerson will serve as a senior strategic advisor to CoPeace, founder and CEO Craig Jonas announced Wednesday. Emerson, a thought leader in the field of impact investing, will advise CoPeace and provide strategic guidance.

Frequently referred to as a godfather of impact investing, Emerson has spent nearly 30 years promoting the good work and promising practices of many of the innovators in the field — and is recognized as a significant practitioner among those championing new approaches to investing, wealth management, and entrepreneurship.

“We’re incredibly excited to be partnering with Jed,” Jonas said. “He’s a great asset and brings a wealth of experience and knowledge about the impact investment space. We’re thrilled to have his support and guidance as we build this CoPeace venture.”

As originator of the term “blended value,” Emerson has spent over two decades exploring how capital investment strategies may be executed to create multiple returns. He has held appointments at Harvard, Stanford, and Oxford business schools and written extensively on impact investing, social return on investment, and related areas.

“I’m especially excited to be joining forces with CoPeace,” Emerson said. “The venture offers a sound approach to aligning the interests of impact investors with those of innovative entrepreneurs through an investment structure focused on the creation of long-term value, as opposed to short term profits.”

CoPeace, a public benefit corporation, is a first-of-its-kind impact holding company. CoPeace views its role and responsibility as a partnership with subsidiaries to create impact for the greater and further-reaching good. This model allows CoPeace to craft a portfolio of companies working towards complementary missions in any given social or environmental subsector, and ultimately to amplify its collective impact output. CoPeace plans to democratize impact investing, leveraging recent updates to legislation, to allow everyday people to use their money as support for the values and solutions they want to see more of in the world.

Impact investing is a growing field, attracting participants from all market segments and walks of life who want to use capitalism as a force for good. Generally, impact investing prioritizes, or at least considers, longer-term impact gains over shorter-term financial gains. Through financial backing, CoPeace fosters sustainable and mission-driven companies in an effort to make the world a more inclusive, peaceful place for future generations.

An impact investing alternative as a modernized holding company

DENVER – Impact investment is a booming segment of the finance industry, as investors address the importance of longer horizons and acknowledge the responsibility the business community has to a global society. Companies of Peace, or CoPeace, support a responsible free market in a way that makes the world a more inclusive and peaceful place for future generations.

As the impact market grows and matures, new models are being pursued that provide evolving and organizing principles. CoPeace utilizes a modernized holding company structure for growing businesses that demonstrate measurable impact. CoPeace serves a network of investors who are socially, environmentally, and politically conscious. Consequently, CoPeace helps to direct these investments into companies that practice corporate responsibility and impact the world in a positive manner.

CoPeace is a public benefit corporation that provides sophisticated financial capabilities, management, along with an umbrella-marketing approach for impact businesses much like a modern Berkshire Hathaway. In addition, attracting impact synergy between responsible companies that share common resources is one of the model’s more powerful advantage.

The company is seeking investments in solid, single-type businesses with 20% internal rates of return instead of risking bets on the next unicorn investment. As Dr. Stephanie Gripne has often been quoted as saying, “Zebras fix what unicorns break.”

As a holding company, CoPeace has the ability to represent multiple companies working together as an investment strategy; growing those companies through cohesive marketing and fiscal expertise, thereby facilitating a positive return with true impact.

CoPeace Adds CFO and SRI Experience to the Team

DENVER, CO – As a socially responsible holding company working with profitable entities demonstrating measurable positive impact, CoPeace has hired Hanan Levin as a Chief Financial Officer (CFO).

Mr. Levin received his undergraduate degree from Yale University and his MBA from University of North Carolina, Kenan-Flagler Business School. As a business professional, Hanan has served as Director of Capital Markets at Bank of the West overseeing and managing the business development of capital markets and fixed income investment throughout the rocky mountain and midwest regions. In addition, he has provided investment advice and added value to institutional clients, municipalities, and corporations utilizing extensive fixed income market knowledge and experience.

Hanan also founded Advanced Sustainable Technologies in Israel that utilizes proven plasma technology and operates a turnkey, scalable plasma waste management facility for corporate clients and governments.

“I was passionate in establishing a sustainable, yet profitable company with AST,” Levin said. “In keeping with that model, I saw great opportunity and good synergy with CoPeace because they listen to the needs of the world and invest in people and companies with great ideas. Together, we can help those companies achieve strong financial returns while enacting profitable returns for investors.”

Attracting impact synergy between sustainability companies that share common resources is just one of the opportunities Hanan will be working on. As a holding company, CoPeace has the flexibility to represent multiple companies working together as an investment strategy to not only grow those companies, but to create a positive return that has both social and environmental impact. CoPeace is unique in that capacity by taking a different angle from the typical venture capital model of looking only at individual companies for the next unicorn.

“We are extremely excited that Hanan is joining our team,” said founder and CEO, Dr. Craig Jonas. “We’ve received a lot of positive feedback from the financial community by adding his deep, diverse skillset that will help us move to the next level. Hanan will lead the team to make sure the MATH supports our decisions and the mission.”

Socially responsible investment, or impact investing is a growing segment of the finance industry as investors address the importance of longer horizons and acknowledge the responsibility the business community has to a global society. Through financial backing, CoPeace supports a responsible free market in a way that makes the world a more inclusive, peaceful place for future generations.

CoPeace PBC Launches as New Impact Investing Alternative

DENVER, CO – As a modern holding venture for profitable companies doing measured good works, CoPeace was recently launched by founder and CEO, Dr. Craig Jonas. CoPeace, short for Companies of Peace, serves a private network of investors who are socially, environmentally, and politically conscious, while directing their money to sustainable companies that practice corporate responsibility and impact the world in a positive manner. Investors will no longer have to worry about the possibility of their money being used by shady shell-corporations, invested in fossil fuels, unsustainable practices, or political super-PACs.

Often referred to as “impact investment,” this modern approach has proved extremely valuable to millennials, women, and disadvantaged populations. CoPeace provides an umbrella for profitable impact businesses, much like a modern Berkshire Hathaway maximizing shareholder value through democratizing investments with the added incentive of social responsibility. CoPeace targets growing, successful companies that support our interdependent future through sustainable and socially responsible practices. and socially responsible practices.

CoPeace is an established Public Benefit Corporation (PBC), and is a pending certified B-Corporation. In a short period of time, CoPeace has built an exceptionally strong team of professionals and continues to grow and gain attention.

“With the current political and social climate, we really felt there was a market for individuals who want to impact the world in a positive way, while being rewarded for it. CoPeace is something that I’ve contemplated starting for several years. I’ve worked as an entrepreneur for the majority of my life and view CoPeace as a meaningful opportunity to leave a lasting, positive impact on our society.” stated Dr. Jonas.

Utilizing the HEAD + HEART + MATH approach, CoPeace invests in profitable companies that do measured positive impact. The model combines a comprehensive, modern financial analysis with quantifiable sustainability and social efforts to determine investment strategies for stakeholders.

“Our goal is to simultaneously encourage and reward companies that demonstrate a concern for social issues, while seeking to provide a profitable, successful investment for our clients. We strive to live our slogan and help people ‘Grow Your Money For Good.’” said Meg Masten, Chief Relationship Officer.

Socially responsible investment is a growing segment of the finance industry as investors address the importance of longer horizons and acknowledge the responsibility the business community has to a global society. Through financial backing, CoPeace supports a responsible free market in a way that makes the world a more inclusive, peaceful place for future generations. “It’s important to have that peace of mind knowing CoPeace is growing your money for good,” added Dr. Jonas.