OVERVIEW

While definitions of “impact investing” can vary slightly, it is generally accepted that impact investing is a type of investing approach that intentionally seeks to produce both positive social and environmental impact and a competitive financial return.

This approach contrasts with traditional investing, which is typically undertaken for the sole purpose of achieving a competitive financial return, or to put it another way, maximizing shareholder value. In traditional investing – unlike impact investing – there are not any social or environmental impact objectives.

“We are caught in an inescapable network of mutuality, tied in a single garment of destiny. Whatever affects one directly, affects all indirectly.”

MARTIN LUTHER KING, JR.

A Short History of Impact Investing

It can be argued that impact investing has a centuries-old spiritual foundation. There have long been people who invest — completely or partially — by the tenets of their religious theology, spiritual beliefs or personal value system.

However, the modern roots of impact investing can be traced to a growing sense in the latter stages of the 20th century that traditional capitalism in general, and traditional investing in particular, weren’t fully meeting the needs of society; and that a change was needed to improve the world today and for future generations.

In the late 1950s and early 1960s, some investor portfolios began to exclude tobacco, alcohol and firearms. The ‘60s also saw some investors removing war-related stocks from their collection of investments. In the ‘70s, environmentalists began excluding the stocks of companies they viewed as damaging the environment. In the ‘80s, socially-conscious investors fueled a disinvestment campaign designed to pressure the South African government to break-up its Apartheid system. In the ‘90s, various environmental and social criteria, and sustainability objectives, emerged as investment considerations for a growing number of investors.

While these various approaches to investing went by a variety of names at the time, today one could lump all of them under the overarching umbrella of “socially responsible” investing.

The formal use of the term “impact investing” didn’t begin until the mid-2000s. Its creation can be viewed as a pushback against profit-at-all-costs (PAAC) business and investing practices, which focus almost exclusively on financial performance, while ignoring the social and environmental problems such practices can create.

Impact investing is a subset of a new approach to capitalism, called the new capitalism, or stakeholder capitalism, in which businesses are designed to add value to society in multiple ways, and work for the benefit of all stakeholders – customers, employees, shareholders and communities. The concept “new capitalism” is grounded in terms like sustainability, fairness, equality, transparency, environmental impact, and social impact. It’s a purpose and profit approach to conducting business.

“Good profits simply are not inconsistent with good behavior.”

WARREN BUFFETT

MANEUVERING THROUGH A MYRIAD OF TERMS AND DEFINITIONS

Potential impact investors can be quickly spooked when confronted by all the terms and definitions in this relatively new area.

Impact investing falls under the wide-ranging umbrella category labeled social investing (or socially conscious investing), which is the general term for an investment that has both financial and social/environmental objectives.

But the field of social investing has a lot of nuance, and thus, a lot of names to describe slightly different approaches. For someone new to the field, the seemingly never-ending assortment of acronyms, terminology and definitions associated with social investing can be confusing.

The perplexing menu of social investing options can leave potential investors on the sidelines, not sure about what action to take, if any.

So, let’s address this issue head on.

First of all, it’s important to note that social investing is not an asset class but a philosophical approach to investing across all asset classes.

Now, let’s move to a brief discussion of some of the more common social investing terms:

Responsible Investing

Responsible investing looks to weed out investments in companies that are commonly perceived to be harmful to society, for example, guns and other weapon manufacturers, tobacco product producers, and heavy polluters.

Responsible investing uses negative screening tools to filter out companies, or entire industries, that have products or services that can negatively impact people or the planet. It’s a “less bad” approach to investing.

Negative screening techniques for socially conscious investments typically don’t consider positive impact criteria, such as companies that have multiple sustainable practices, or those companies that produce products or sell services that address specific social or environmental problems, for example, clean technology companies.

Negative screening is also sometimes called greenwashing or ethical investing, two other terms that investors use when they’re looking to “clean up” their portfolios.

Sustainable Investing

Sustainable investing is an investment approach that uses environmental, social and governance (ESG) criteria to help choose companies to invest in. The term ESG can be traced back to 2005 when it was used in a landmark study entitled “Who Cares Wins.”

ESG criteria are a set of standards for business operations that social investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature. Social criteria analyze how a company handles relationships with employees, suppliers, customers, and the communities where it operates. Governance criteria look at areas such as a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Using ESG criteria in analyzing potential investments is increasingly popular among investors. Sustainable investors typically use ESG screening techniques to avoid investing in companies with poor ESG records. An increasing number of mutual funds, brokerage firms, and robo-advisors now offer products that utilize ESG criteria screens.

Triple Bottom Line Investing

Triple Bottom Line (TBL) — also known as Integrated Bottom Line, and The Three Pillars — involves investing in companies who, as part of their mission, want to positively impact “people, planet and profit” in some way.

The TBL concept was first introduced by John Elkington in 1994. His intention was to develop a way to measure a company’s overall impact on society.

In practice, TBL is a type of accounting methodology that results in companies reporting their progress in the three areas of people, planet and profit. Through the years, TBL companies have used a variety of measurement tools. However, there is no standard TBL measurement method.

TBL investing is closer to responsible investing and sustainable investing than it is impact investing. A key difference between TBL and impact investing is that the specific mission of impact companies is to develop products and services that directly address social and environmental challenges. TBL companies, on the other hand, conduct business in a wide variety of industries and have products and services that may or may not have any specific positive social or environmental impact. However, whatever their industry, they look to report progress in the three pillar areas: people, planet and profits.

What about crowdfunding?

Crowdfunding isn’t a type of social investing per se. However, in some cases, it occupies the space between traditional philanthropy and social investing. For some socially conscious consumers and investors, it has become a popular way to easily and quickly support companies – usually small startups that are addressing social and environmental issues in some way – via online payment platforms. A big difference between crowdfunding and the various types of social investing is that crowdfunders may or may not receive a financial return in the form of a dividend or stake in the company. That said, some of these companies give crowdfunders a gift, or one or more of the company’s products, in lieu of a financial return.

Impact Investing

The driving objective of Responsible Investing, Sustainable Investing, Triple Bottom Line Investing, Ethical Investing, Negative Screening and Greenwashing, etc., is to “do no harm.”

There is certainly nothing wrong with that objective. However, impact investing is designed to not only “do no harm” but to also “do good” through investments in companies created specifically to address important social or environmental problems. Impact investing is based on the principle of using the power of capital for the greater good.

In addition, the impact investing space prioritizes – on equal terms — social and environmental impact, along with profitability. That’s not necessarily the case with the social investing approaches highlighted above.

Impact investing has the potential to positively address a wide range of global issues: the climate crisis, accessible water and power, affordable housing, equitable labor practices, sustainable farming, clean energy, and many more.

THE DRAMATIC GROWTH OF IMPACT INVESTING

Impact investing is growing rapidly, especially with younger audiences who are looking to make a difference by investing in positive impact companies. Younger generations are drawn to impact investing because they see no reason to separate philanthropy from investing.

Impact investing has enjoyed explosive growth the last five years, driven to a large degree by Millennials (those born between 1980-’94) and the Gen Z generation (those born between 1995-’15), who want their investments to do more than just make money.

That said, it is not just young investors that have spiked impact investing’s growth. The number of impact investors is rising across all demographic categories. These impact investors have also been described as personal values investors, in that they want their investments to be in alignment with their personal values. In doing so, their intent is to make their investment portfolios a statement of who they are and what they stand for.

The impact-investing sector has doubled in size the last two years, according to Global Impact Investing Network’s 2019 Report on Sizing the Impact Investing Market. According to the same report, impact investors say their impact investing allocations will continue to grow.

“Yes, profits are important, but so is society. And if our quest for greater profits leaves our world worse off than before, all we will have taught our children is the power of greed.”

MARC BENIOFF

Salesforce founder and co-CEO

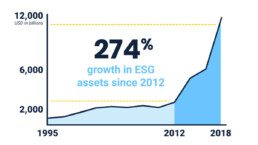

Investments that take into consideration environmental, social and governance (ESG) factors now stand at $12 trillion, according to US SIF’s 2018 Report on U.S. Sustainable, Responsible and Impact Investing Trends. That’s approximately 1 in 4 dollars of the $46.6 trillion in total assets under professional management in the U.S. This represents a dramatic 38 percent increase over 2016.

The US SIF report—first compiled in 1995—is the most comprehensive study of sustainable and impact investing in the United States. From the first report compiled 25 years ago, when assets totaled just $639 billion, to today, the sustainable and responsible investing industry has grown 18-fold and has matured and expanded across numerous asset classes.

“In every asset class, in every region, ESG product development is the thing right now,” said Alex Bernhardt, U.S. head of responsible investments at investment consultant Mercer. 11

One key factor driving impact investing is the increasing presence of Millennials in the investing marketplace. As noted on the following page, 95% of Millennials are interested in impact investing and by 2025, Millenials are expected to make up about 75% of the American workforce. According to a study by Coldwell Banker Global Luxury, by 2030, Millennials will hold five times as much wealth as they have today and are expected to inherit over $68 trillion from Baby Boomers over the next 30 years in what’s been called “The Great Wealth Transfer.” 12 Those numbers indicate the potential for exponential growth in the impact investing sector over the next decade.

Millennials and Gen Zers have been the driving force behind “The Era of the Conscious Consumer.” Conscious consumers typically shop organic, and buy clothes, cars and other products from companies with social and/or environmental objectives. Similarly, “conscious investors” are increasingly letting their personal values drive their approach to investing. They are also demanding more transparency from their investments. As such, “The Era of the Conscious Consumer” is evolving to include “The Era of the Conscious Investor.”

Despite this strong growth in the impact-investing sector, financial advisors have been slow to recognize and appreciate the impact-investing growth trend. Only 43% of financial advisors say impact investing is an important part of their financial planning practice today, according to Eaton Vance’s Advisor Top-of-Mind Index. 16

On the other hand, large institutions and private foundations have adopted impact investing approaches at a faster rate than independent financial advisors. They have been key drivers of growth in the impact investing space as they are increasingly adopting more responsible investment strategies.

Once financial advisors become more aware of the interest many of their clients have in impact investing – especially as more and more Millennials and Gen Zers enter the investing marketplace — and understand the potential impact investing represents for their practices, they will undoubtedly become more adept at presenting impact investing opportunities to their clients. The result will be another boost to the impact investing sector.

IMPACT INVESTING AND THE ISSUE OF RISK

The biggest concern that most investors express regarding impact investing is a fear that impact investments might not provide a competitive financial return. They are concerned that “doing good” might be too costly for companies and negatively impact their financial performance.

In fact, two-thirds of investors report being worried that impact investments might not offer competitive returns and that investing sustainably could require a financial tradeoff. U.S. asset managers have said that they view this perception as one of the greatest challenges to sustainable investing.

However, a look at the research in this area reveals a picture in which impact investments — investments in companies that weigh social, environmental and financial objectives equally — have performed as well financially as traditional investments, if not better.

A 2014 study conducted by CDP Global 500 Universe found that S&P 500 companies that are leaders on climate change generated an 18% higher return on equity (ROE), lower volatility of earnings, and 21% stronger dividend growth than low-scoring peers.

Similarly, a highly regarded 2016 study, led by George Serafeim of Harvard Business School, found that stocks of companies with the strongest performance on ESG issues outpaced those with poor ESG performance.

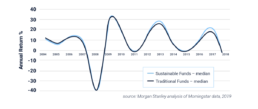

In addition, a Morgan Stanley study compared the performance of sustainable funds with traditional funds from 2004-2018 using Morningstar data. A total of 10,723 funds were studied. Researchers found that sustainable funds provided returns in line with comparable traditional funds while reducing downside risk. During a period of extreme volatility, they discovered strong statistical evidence that sustainable funds are more stable. The study found that sustainable funds experienced a 20% smaller downside deviation than traditional funds. This was a consistent and statistically significant finding.

As such, considering ESG criteria can help investors avoid companies that might pose a greater financial risk due to their less-than-ideal environmental practices.

From a corporate management perspective, CEOs and company directors are now realizing that ESG issues are strongly associated with financial performance. They understand that more and more consumers — especially younger consumers — are demanding that the companies they do business with perform well on ESG criteria. As such, they are increasingly placing a greater emphasis on ESG performance at their companies.

The bottom line is, companies that utilize ESG criteria in their management practices are typically well-managed companies and as a result consistently have better financial performance.

It turns out that “doing good” is also good business.

There’s one more point to make here and it’s about the true costs of doing business. If companies don’t do things the right way — polluting our lakes and rivers, for example — we all, as a collective society, have to pick up those costs. As such, a company’s true costs of doing business should be factored into its overall performance.

THE COPEACE APPROACH TO IMPACT INVESTING

The root of many of our social and environmental problems in the world today is the quest for profit-at-all-costs (PAAC).

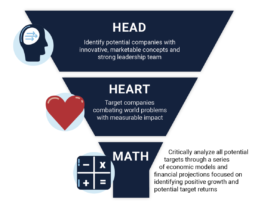

CoPeace seeks to mitigate that unfortunate reality with investments in companies whose specific mission is to work to solve social and environmental problems, while still being profitable and providing competitive returns to investors.

CoPeace is a first-of-its-kind holding company that only invests directly in impact companies. Unlike most direct investments, virtually anyone can invest in CoPeace — not just wealthy, accredited investors. As such, CoPeace is changing the impact investing landscape so smaller investors can share similar footing with accredited investors when it comes to direct impact investing.

To that end, CoPeace has chosen to develop a unique direct public offering (DPO). In effect, CoPeace is democratizing the investment process by providing an innovative and inclusionary platform that allows impact investors, of all demographic types, unprecedented access to impact companies.

The CoPeace mission is to impact the lives of global citizens through investments in companies that are working to make the planet a more equitable, safer and healthier place to live. Furthermore, the company’s intent is to be part of the growing transition from traditional — “shareholder value only” — investing to impact investing, in which social and environmental performance is considered on par with financial performance.

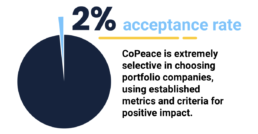

CoPeace is extremely selective in choosing which impact companies the company invests in. Due to a rigorous screening process, CoPeace only invests in about 2% of the companies it analyzes.

Unlike “socially responsible” mutual funds and ETFs, CoPeace’s portfolio consists of a small number of carefully-selected companies “doing good,” i.e., having measurable positive social, environmental and financial impact, as opposed to funds with numerous companies doing some things “less bad.” These “less bad” companies are what make up the “responsible” and “sustainable” mutual funds and ETFs currently in the marketplace.

Finally, it’s important to note, CoPeace is registered as a Public Benefit Corporation PBC), and is also a Certified B Corp®. Only about 400 companies, worldwide, have achieved both a PBC and B Corp designation. This reflects CoPeace’s high degree of social consciousness.

“Over the next 20 years, the positions we have taken...will lead to an understanding that...the way you invest matters. We will see our guiding principles integrated into the mainstream. We will be astonished at the acceptance and the impact that we have had.”

AMY DOMINI

Founder of Domini Impact Investments

CONCLUSION

Historically, there has been a common misconception that profits and positive impact on society are mutually exclusive. To a large degree, this is because the current global capitalism structure – including the investment sector — prioritizes profits over people and planet.

Impact investing offers a different option, one in which the environment and society are on equal footing with profits. As such, impact investing is not only changing the traditional investing world, but also helping to transition capitalism from a profit-at-all-costs mindset to a New Capitalism mindset, in which an equal emphasis is placed on social, environmental and financial performance.

CoPeace has embraced this new approach to capitalism in general and investing in particular. The company has taken the Berkshire-Hathaway holding company model and modified it so that the only companies that become part of CoPeace are companies that have been thoroughly screened in order to meet high standards in the areas of social, environmental, and yes, financial impact. Moreover, CoPeace’s unique investing model has democratized a process that historically has been the sole domain of wealthy, accredited investors.

As Martin Luther King, Jr. pointed out in the quote that opened this paper, we are all part of an “inescapable network of mutuality.” Therefore, our challenge, as a global society, is to work together to make the world we share as safe, healthy, just, sustainable and prosperous as possible – for all of us.

To that end, the overarching objective at CoPeace is simple: Make the world a better place and get as many people from as many demographic categories as possible involved in the process.

“Impact investing is an entry point to an exploration of the purpose of capital because it begins with our understanding that how we presently think about capital’s place and purpose in our world is not adequate nor enough to confront the challenges before us, as a planet and as a people.”

JED EMERSON

The Purpose of Capital

SHARE THIS